January 17, 2025 I Dhan Manage

India’s stock market, often hailed as a beacon of emerging market growth, has recently faced a sharp downturn, leaving investors worried and financial analysts dissecting the causes. With benchmarks such as the Sensex and Nifty 50 showing declines, questions loom over the market’s trajectory. While global headwinds play a significant role, domestic factors have also contributed to the turbulence.

This article explores the key reasons behind the Indian market’s recent slump and provides insights into how these factors might shape its recovery.

Key Reasons Behind the Indian Market Downfall

1. Global Economic Headwinds

The Indian market’s downturn is not isolated—it reflects global economic challenges. Several international factors, including:

- Rising Interest Rates Globally: The U.S. Federal Reserve and other central banks continue to raise interest rates to curb inflation. This has reduced global liquidity and triggered foreign fund outflows from emerging markets like India.

- Geopolitical Tensions: Ongoing geopolitical conflicts, such as the Russia-Ukraine war and tensions in the Middle East, have disrupted global trade, increased oil prices, and created market volatility.

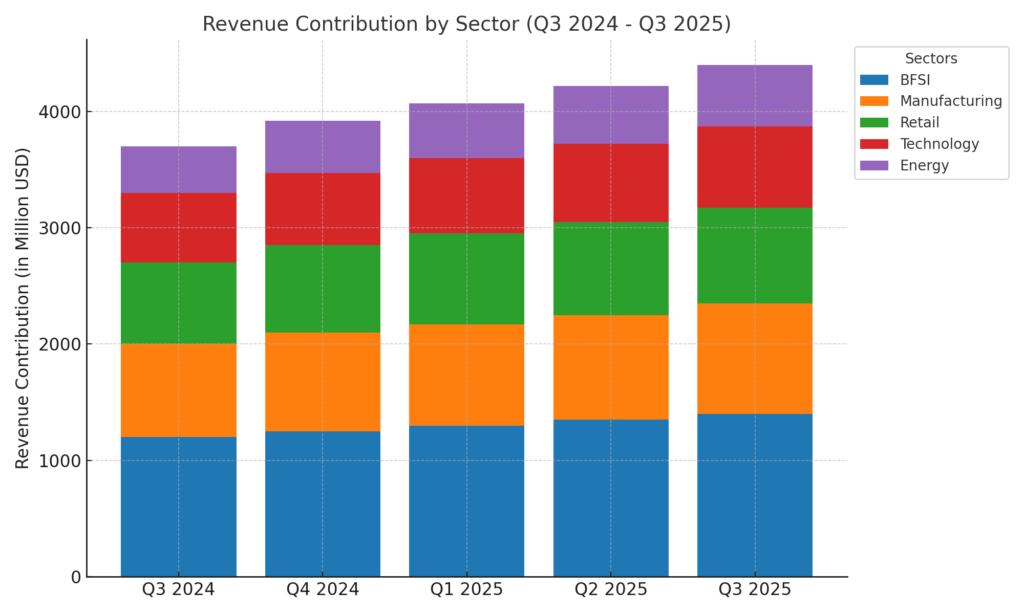

- Global Slowdown Fears: Weakening demand in key markets, including Europe and the U.S., has hurt India’s export-driven sectors like IT and manufacturing.

2. Weak Corporate Earnings

Indian corporations have faced muted earnings growth in recent quarters. Several factors contributing to this include:

- Higher Input Costs: Rising raw material prices have squeezed profit margins, particularly in sectors like FMCG, automotive, and construction.

- Slow Consumer Demand: Persistently high inflation has curbed consumer spending, impacting companies reliant on domestic consumption.

- Sector-Specific Challenges: IT services and startups, for instance, have faced a slowdown in global demand and funding challenges, respectively.

3. Foreign Institutional Investor (FII) Outflows

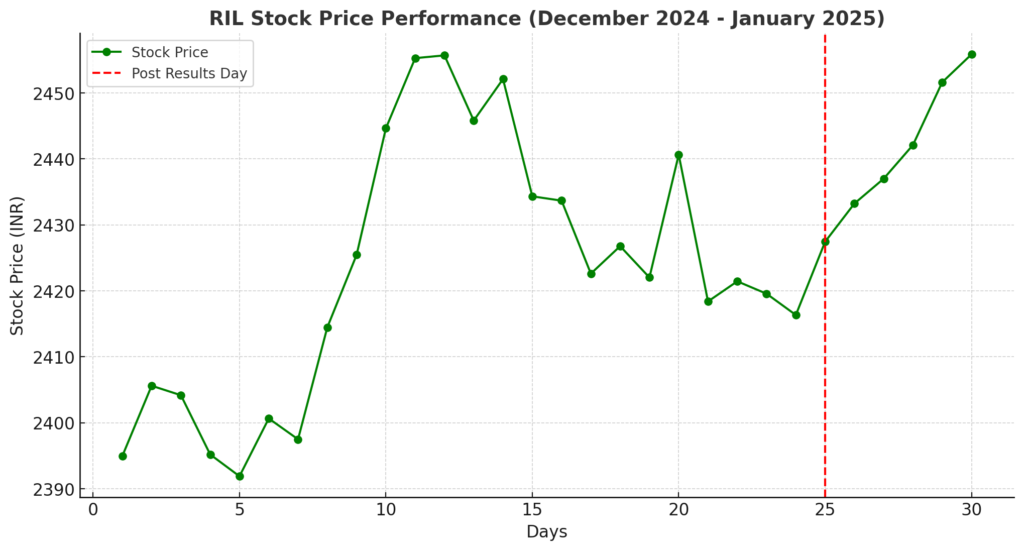

Foreign institutional investors (FIIs), who significantly influence India’s stock markets, have been pulling out funds due to rising yields in developed markets. FIIs sold heavily in December 2024 and January 2025, leading to downward pressure on Indian equities.

4. Macroeconomic Concerns

India’s macroeconomic indicators have added to market woes.

- Persistently High Inflation: Despite cooling off from 2024 peaks, inflation remains a concern, eroding purchasing power and affecting market sentiment.

- Rupee Depreciation: The Indian Rupee has been under pressure against the U.S. Dollar, increasing import costs and further impacting sectors like oil and gas.

- Fiscal Deficit Worries: The government’s higher spending on subsidies and welfare programs has raised concerns about fiscal discipline, adding to investor anxiety.

5. Regulatory and Policy Uncertainty

Frequent changes in government policies have also spooked investors. Recent taxation changes, including higher capital gains tax expectations and stricter compliance measures, have created uncertainty among domestic and foreign investors.

How the Market Could Recover

Despite the ongoing challenges, the Indian market has a strong foundation for long-term growth. Here’s what could drive recovery:

- Resilient Domestic Economy: India’s GDP growth, while moderated, is expected to remain among the highest globally, driven by domestic consumption and infrastructure spending.

- Policy Support: Government initiatives, including incentives for manufacturing and infrastructure projects, could boost investor sentiment.

- Cooling Inflation: Easing inflation could help revive consumer demand and corporate earnings.

- FII Re-Entry: Stabilization in global markets may encourage FIIs to return to Indian equities, particularly in sectors like banking, technology, and renewable energy.

Conclusion

The recent downturn in the Indian stock market underscores the complex interplay between global and domestic factors. While challenges such as global monetary tightening, FII outflows, and inflation persist, India’s long-term growth potential remains robust.

For investors, this could be an opportunity to focus on quality stocks with strong fundamentals and a long-term outlook. As market cycles evolve, resilience and strategic policymaking will be critical in restoring confidence and setting the stage for a rebound in India’s equity markets.