Persistent Systems Announces Stellar Q3 2025 Financial Results with Strong Revenue and Profit Growth

Persistent Systems, a global leader in digital engineering and AI-driven innovation, has released its Q3 2025 financial results, showcasing remarkable growth in revenue, net profit, and operating margins. The company also highlighted its strategic achievements, client engagements, and industry recognitions, further cementing its position as a pioneer in the IT and digital transformation space.

Key Financial Highlights for Q3 2025

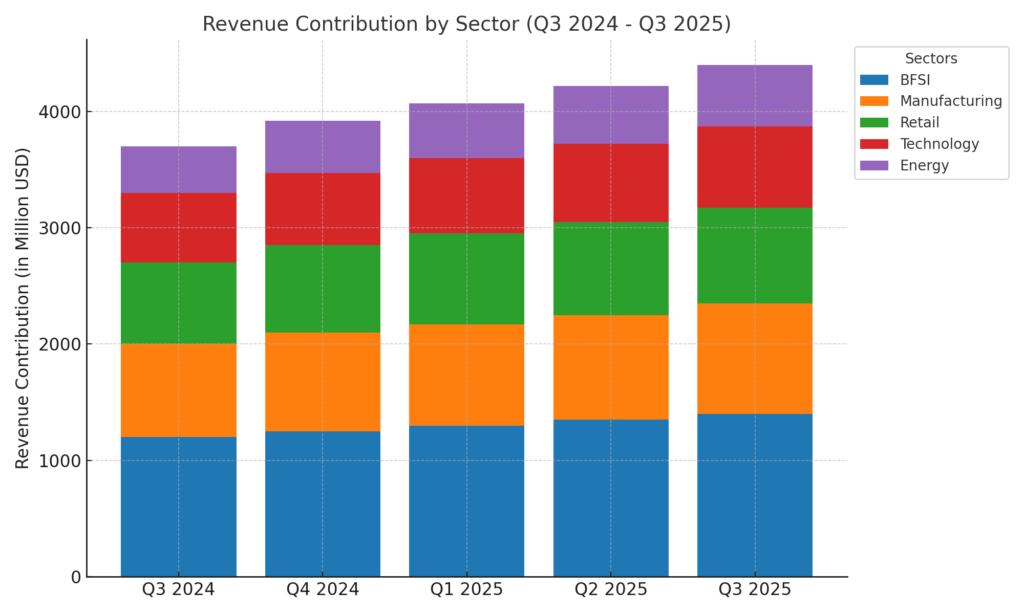

- Revenue Growth: Persistent Systems reported a 4.3% quarter-over-quarter (QoQ) increase in revenue, reaching $360.2 million. This represents a significant 19.9% year-over-year (YoY) growth, reflecting the company’s strong market traction and consistent performance.

(Learn more about Persistent Systems’ revenue growth strategy here.) - Net Profit: The company’s net profit surged to ₹3,729.9 million, marking a 14.8% QoQ and 30.4% YoY increase. This growth underscores Persistent Systems’ operational efficiency and ability to deliver value to stakeholders.

(Explore how Persistent Systems achieves profitability here.) - Operating Margin: The operating margin improved by 90 basis points to 14.9%, breaking a two-quarter stagnation trend. This improvement highlights the company’s focus on cost optimization and operational excellence.

Strategic Achievements and Innovations

Persistent Systems continues to lead the industry with its AI-driven innovations and strategic initiatives:

- SASVA™ Platform: The company filed over 20 patents related to its AI-powered software development platform, SASVA™, reinforcing its commitment to innovation and cutting-edge technology.

(Discover more about SASVA™ and its capabilities here.) - ContractAssIst Launch: Persistent introduced ContractAssIst, a groundbreaking tool leveraging Microsoft 365 Copilot to streamline contract management processes. This solution enhances efficiency and delivers significant value to clients.

Client Engagements Across Key Industries

Persistent Systems secured significant client wins across diverse sectors, further solidifying its reputation as a trusted partner for digital transformation:

- Software and Hi-Tech: Modernized product development for a leading UK-based business software provider using the SASVA™ platform, enabling faster time-to-market and improved scalability.

- Banking and Financial Services: Revamped enterprise gateway services for a global payment technology company, enhancing scalability and operational efficiency.

- Healthcare and Life Sciences: Transformed patient care platforms for a major healthcare provider, improving patient experiences and reducing technology debt.

(Read more about Persistent Systems’ client success stories here.)

Industry Recognitions and Awards

Persistent Systems’ dedication to excellence and sustainability has been recognized through prestigious awards:

- ISG Star of Excellence™ Overall Award: Awarded for delivering superior customer experience, reflecting the company’s commitment to client satisfaction.

- Dow Jones Sustainability World Index: Inclusion in this index highlights Persistent Systems’ focus on sustainable business practices and ESG initiatives.

Dividend Declaration for FY 2024-2025

Demonstrating confidence in its financial health and growth prospects, the Board of Directors declared an interim dividend of ₹20 per share for the financial year 2024-2025. This move underscores the company’s commitment to delivering value to its shareholders.

Conclusion

Persistent Systems’ Q3 2025 financial results highlight its robust performance, driven by AI-led innovations, platform-driven services, and a strong focus on client satisfaction. With significant growth in revenue, net profit, and operating margins, the company is well-positioned to maintain its leadership in the global IT and digital engineering landscape.

(Visit Persistent Systems’ official website here for more details on their latest financial results and strategic initiatives.)