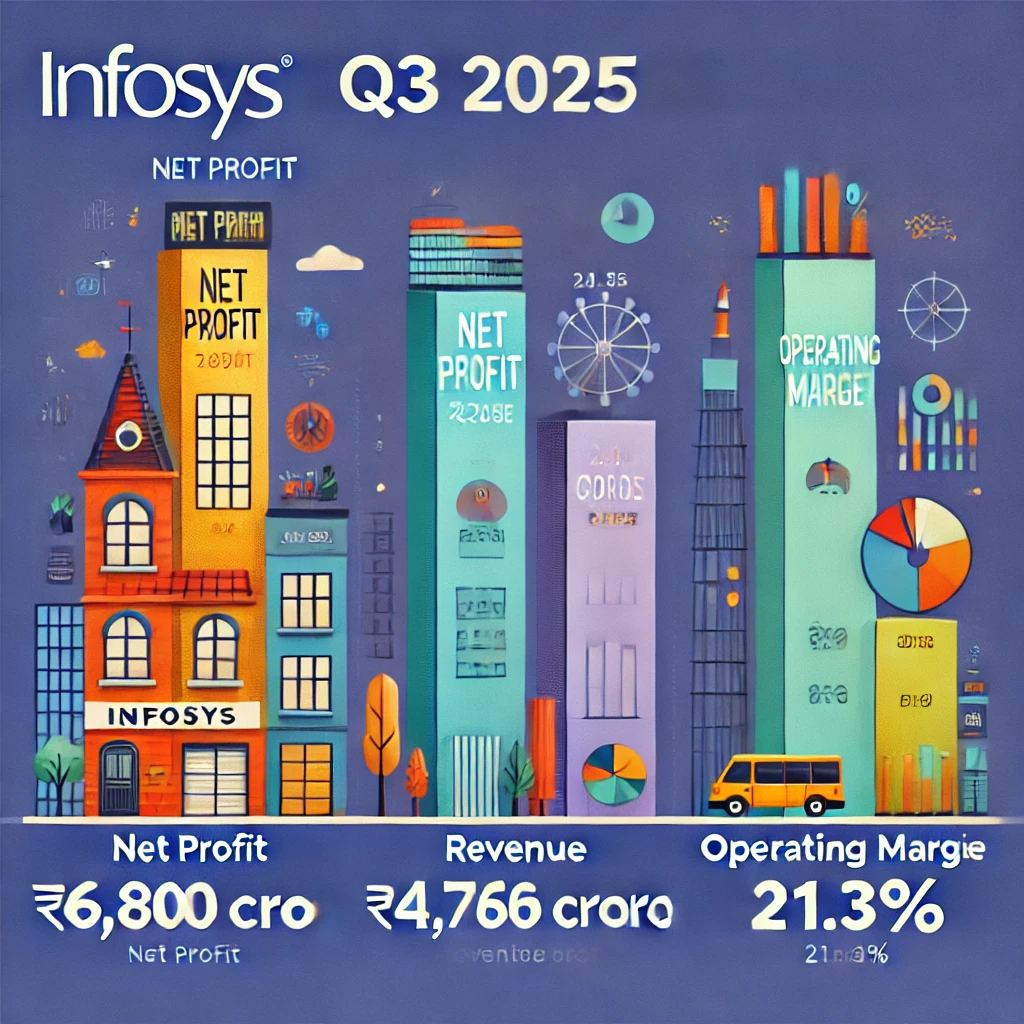

Key Financial Highlights

- Net Profit: ₹6,806 crore (11% YoY increase)

- Revenue: ₹41,764 crore (8% YoY increase)

- Operating Margin: 21.3% (80 basis points increase)

This performance showcases Infosys’ ability to navigate market challenges, deliver strong earnings, and expand its operational efficiency.

Revenue Growth and Guidance

- Infosys revised its full-year revenue growth guidance upwards to 4.5%-5% in constant currency terms.

- This reflects sustained demand across key sectors, especially in digital services and AI.

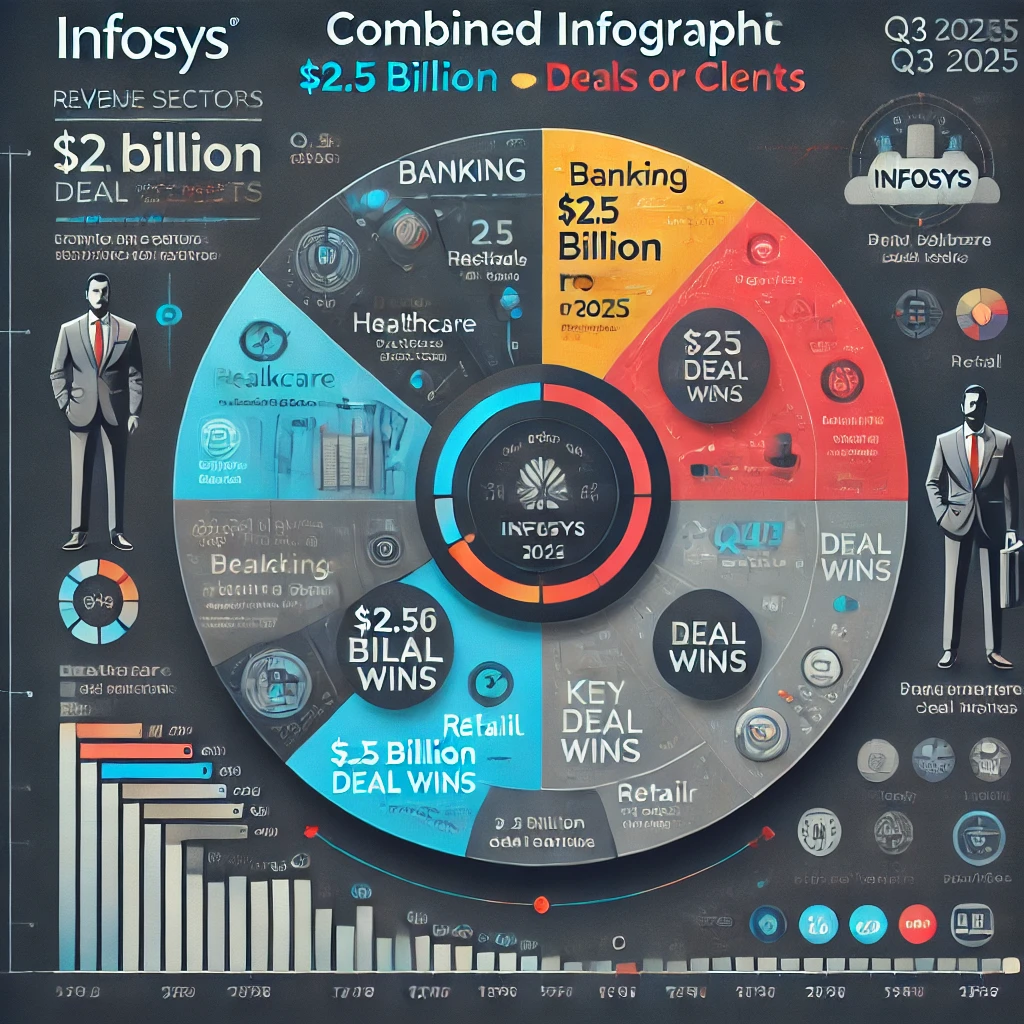

Client Acquisition and Deal Wins

- 101 new clients were added during the quarter, reflecting strong demand for Infosys’ services across global markets.

- Secured $2.5 billion in large deal bookings, underscoring healthy deal momentum.

Client Growth: A breakdown of these new clients across regions and industries could be shown visually here.

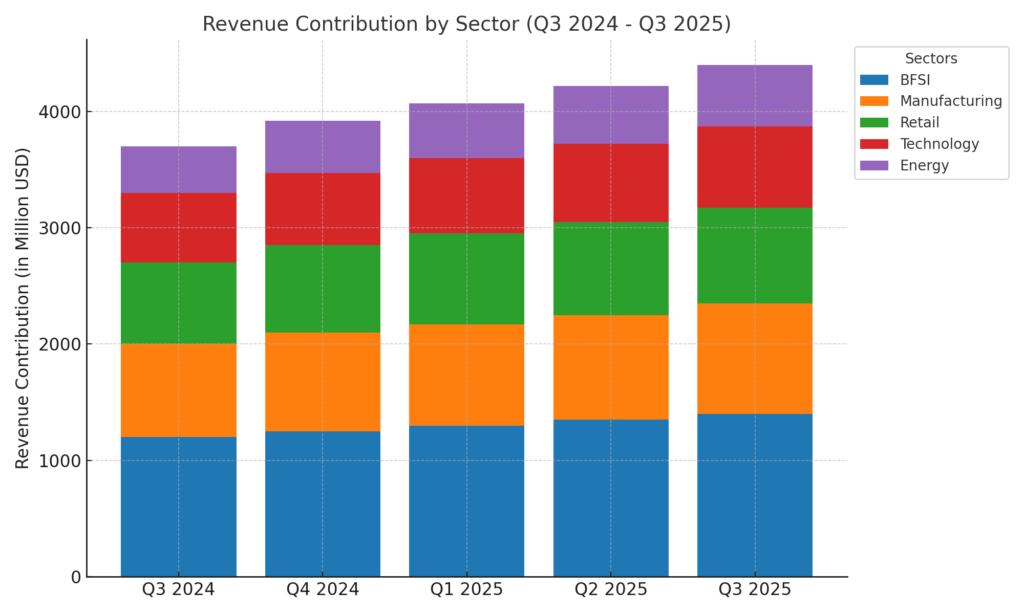

Sectoral Performance

- Banking, Financial Services, and Insurance (BFSI): 6.1% growth YoY

This key sector continues to be a strong performer for Infosys, driving consistent revenue growth.

Emphasis on Artificial Intelligence

- Infosys is expanding its AI and automation offerings to cater to growing demand for generative AI solutions in areas like cloud services and data analytics.

- AI Adoption: A visual depiction of AI-powered solutions in various industries (Finance, Retail, Healthcare, etc.) could drive the point home.

Market Reaction

- Despite a strong quarter, Infosys’ stock dropped 6% in early trading, indicating market volatility.

A news headline snippet with the stock price dip and market analysis can provide context.

Conclusion

- Strong Profit Growth: 11% YoY increase in net profit

- Sustained Revenue Expansion: 8% YoY increase

- AI and Digital Transformation: Strategic investments in future-ready technologies.

This visual summary captures Infosys’ Q3 performance in a reader-friendly, concise manner.