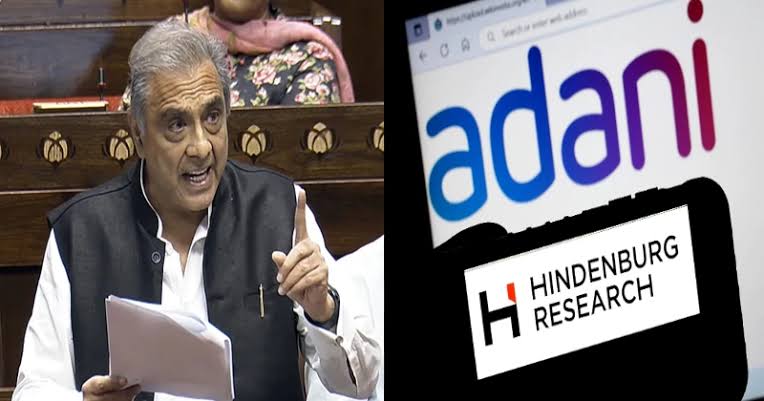

In a fiery statement to NDTV, senior lawyer Mahesh Jethmalani slammed Hindenburg Research and its chief, Nate Anderson, for their role in destabilizing the Indian market with what he termed as a “hit job.” His remarks come in the wake of Hindenburg’s announcement to wind up operations, sparking debates over accountability and the motivations behind their controversial actions.

Hindenburg’s Exit: An Evasive Maneuver or Genuine Conclusion?

Nate Anderson, the founder of Hindenburg Research, recently declared that the firm was shutting down due to the intense nature of its work. However, this decision has raised eyebrows, with critics like Jethmalani suggesting that it might be an attempt to evade potential investigations.

“Their claim to fame rests solely on the Adani ‘hit job.’ Beyond that, there is no significant or credible body of work to their name. It’s clear that the disruption they caused to India’s economy was deliberate and targeted,” Jethmalani stated.

Adani Group Fallout: The Cost of Speculation

Hindenburg’s allegations against the Adani Group not only rattled investor confidence but also wiped out billions in market value, with small-time investors bearing the brunt. Jethmalani expressed outrage at the lack of accountability, stating, “Now Anderson says, ‘I’m off, I’m done.’ How does one ensure justice for the havoc they wreaked?”

Accountability and the Role of SEBI

The Securities and Exchange Board of India (SEBI) is investigating the matter. However, Jethmalani pointed out the challenges of prosecuting a US-based entity. He highlighted the potential influence of global players like George Soros, alleging that anti-India sentiment fueled Hindenburg’s actions.

“George Soros, a known financier of anti-India campaigns, has been a significant supporter of the Democratic Party in the US. This ‘deep state’ alliance raises questions about the timing and nature of Hindenburg’s actions,” he remarked.

Hopes for International Collaboration

Jethmalani expressed optimism that the incoming Trump administration could initiate a probe into Hindenburg’s operations, aiding India in holding the firm accountable. “We should seek help from friendly governments to ensure that this man and his associates are brought to justice,” he added.

Mukul Rohatgi: “Hindenburg’s Actions Were a Shoot-and-Scoot Strategy”

Former Attorney General Mukul Rohatgi also weighed in, describing Hindenburg as a “dubious organization” focused on destabilizing markets for profit.

“Hindenburg’s modus operandi is clear: they short sell, create market panic, and then disappear. Their decision to shut down is likely an attempt to avoid facing investigations in India or the US,” Rohatgi said.

The Political Angle: Opposition and JPC Probe Demand

The Hindenburg-Adani controversy has sparked political debates, with opposition parties demanding a Joint Parliamentary Committee (JPC) probe. However, India’s Supreme Court and investigative institutions have dismissed Hindenburg’s allegations as baseless.

At the Adani Group’s annual general meeting in June 2025, Chairman Gautam Adani addressed the issue, saying, “We faced baseless accusations made by a foreign short seller. Despite the attack on our integrity and reputation, we stood resilient and proved our strength.”

Conclusion: A Call for Accountability

Hindenburg’s sudden exit has left many unanswered questions about its motives and operations. As calls for justice grow louder, Mahesh Jethmalani’s fiery remarks underline the need for stricter mechanisms to hold entities like Hindenburg accountable for their actions.

This unfolding saga is a stark reminder of the need for robust regulatory frameworks and international cooperation to protect economies from malicious actors.